At these meetings, we review the Bank’s position, the economic situation in Iceland and respond to any questions they may have. These investors are generally very well informed about the Icelandic banks and closely monitor developments in the country. Since the Bank resumed issuing bonds abroad following the financial crisis, we have placed strong emphasis on building trust among investors. As Landsbankinn is a systemically important bank in Iceland, it is subject to the same regulatory requirements as the largest banks in Europe, which enhances investors’ confidence in the Icelandic banking system. The Bank’s balance sheet is relatively simple, as the vast majority of its assets consist of customer loans and liquid assets, and the Bank is performing well. Investors value this highly and this has allowed us to broaden the Bank’s investor base, as was evident in the Bank’s bond issuances in 2025, which were oversubscribed multiple times, and in the fact that the Bank’s funding costs continued to decline.

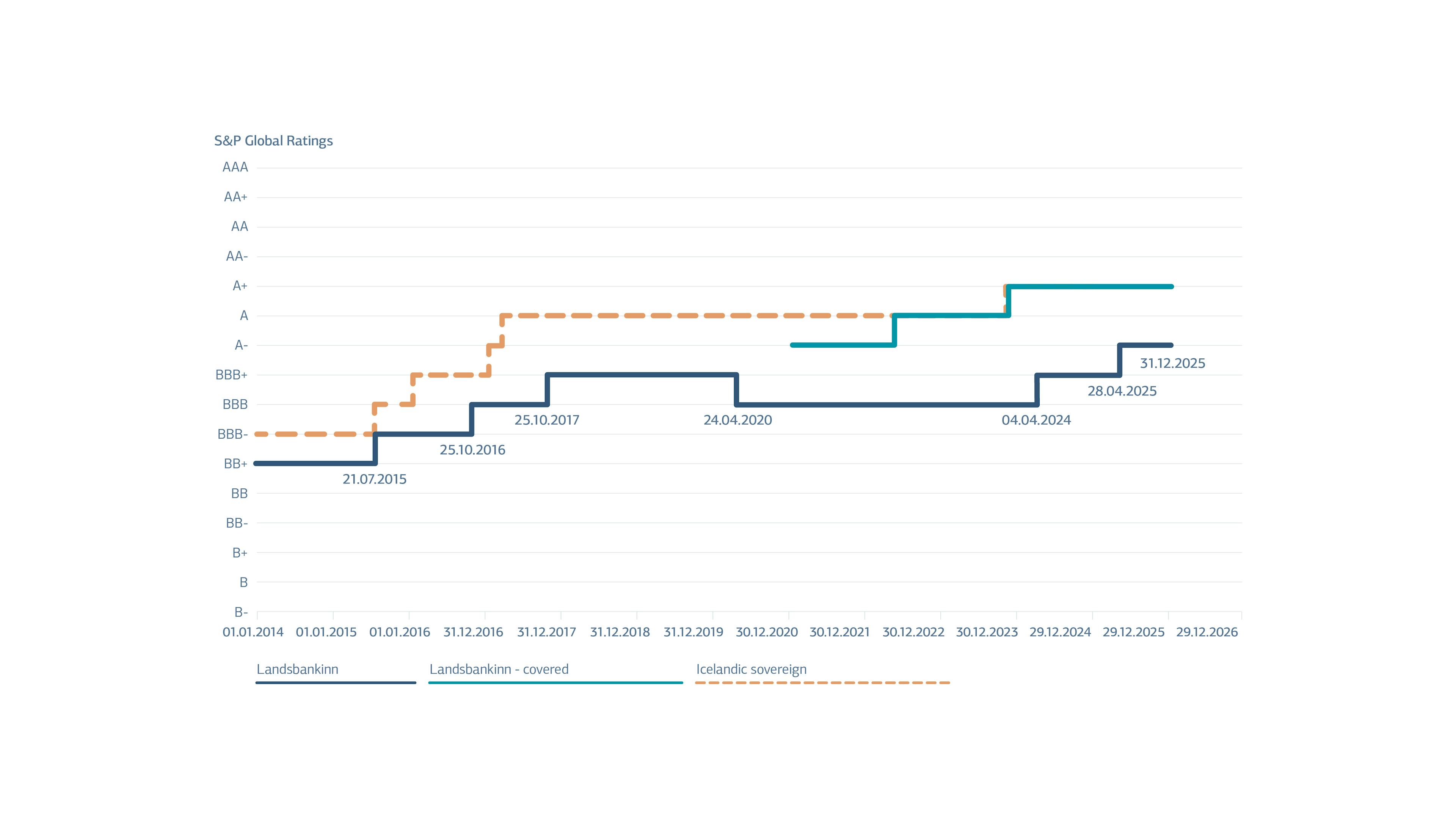

The year 2025 was eventful in foreign funding. A major milestone was reached in February when the Bank completed its first issuance of Additional Tier 1 (AT1) securities. The issuance amounted to USD 100 million and represented an important step toward a further optimised capital structure for the Bank. The Bank’s continued issuance of senior non-preferred bonds in Swedish and Norwegian krona subsequently led S&P to upgrade the Bank’s credit rating to A-. Reaching the A rating category was an important milestone. Landsbankinn also issued two EUR-denominated green bonds on favourable terms, the latter with a seven-year maturity, marking the longest maturity for a senior issuance by the Bank to date. At the same time, the Bank took the opportunity to repay older and less efficient funding. The prerepayment resulted in a charge to the Bank’s income statement in the fourth quarter, which among other things had a negative impact on net interest income for the quarter, but strengthens the Bank’s net interest margin over the longer term."