Cookies

By clicking "Allow All", you agree to the use of cookies to enhance website functionality, analyse website usage and assist with marketing.

More on cookiesOrganised and effective approach

We put a great deal of effort into knowing the environmental impact of our operation. We continue to analyse our carbon footprint and our impact on society.

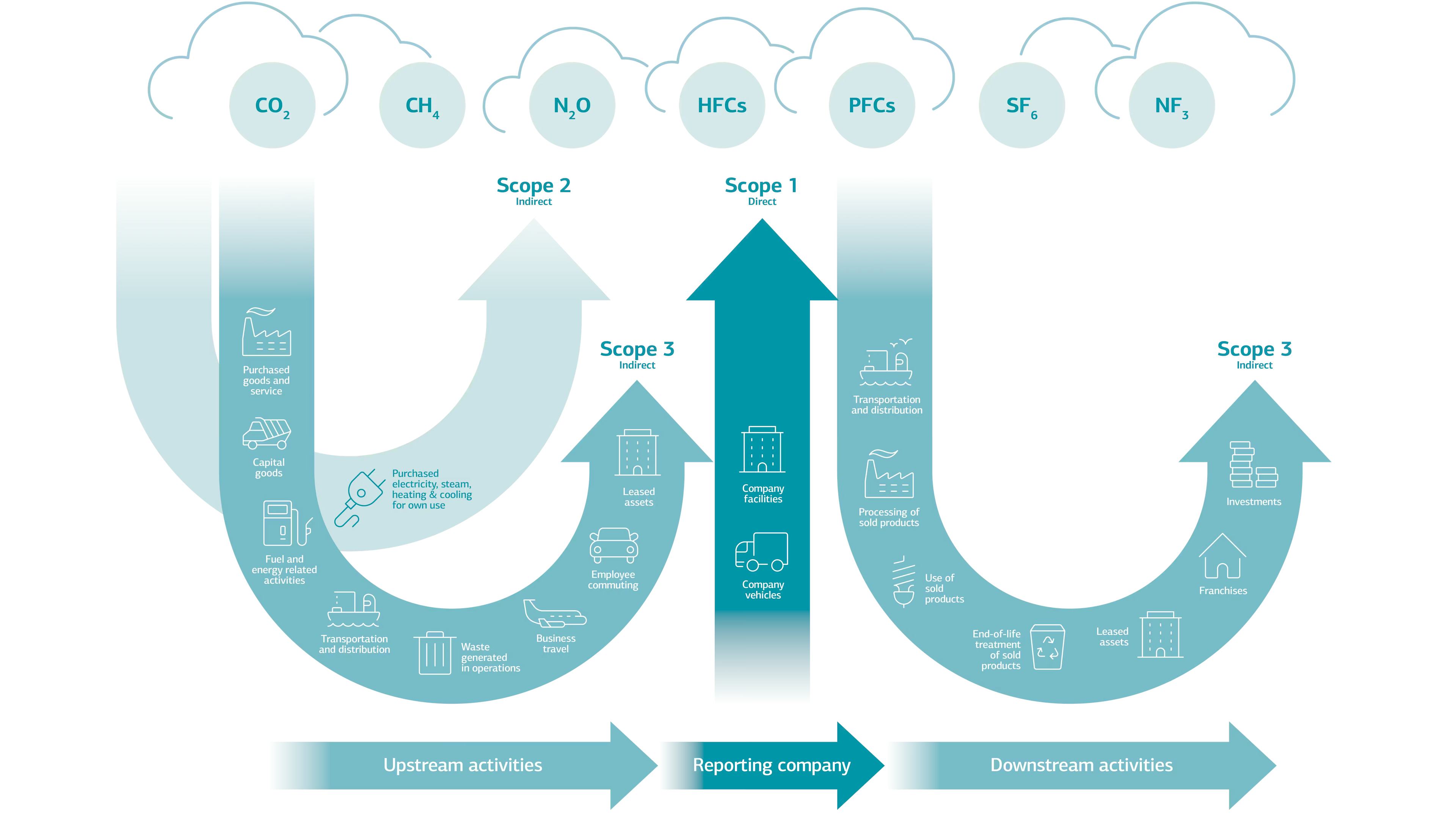

Landsbankinn carries out an in-depth analysis of both the direct and indirect environmental impact of the Bank’s value chain based on the internationally approved methodology GHG Protocol, the methodology generally used by businesses to calculate their carbon footprint. Calculation and disclosure of greenhouse gas (GHG) emissions from the Bank’s loan and asset portfolios is based on the methodology of the Partnership for Carbon Accounting Financials (PCAF). We are also working towards a science-based target to reduce emissions, verified by SBTi as discussed above.

GHG Protocol methodology

Source: WRI and WBCSD

Total emissions

Landsbankinn's total emissions (scopes 1 and 2) have decreased by 3.5% from 2024. Emissions under Scope 3, excluding financed emissions, have contracted by 11% from 2024. Emissions from vehicles decreased by 19% compared with 2024. The reduction in Scope 3 emissions can be attributed, among other things, to more environmentally friendly travel by employees and a decline in purchases of computer and technical equipment following significant upgrades associated with the move to the new headquarters in the preceding years. As a result, there was not the same need for replacement in 2025.

Waste sorting and recycling

Landsbankinn has in recent years worked systematically to reduce its impact on the environment through waste, working both to reduce emissions and contribute to evolution of the circular economy by reusing and recycling.

In the span of just five years, the ratio of sorted waste has increased from around 55% to just under 93% in 2025. Alongside higher sorting ratios, recycling and reuse of waste from the Bank has also increased to 97% in 2025, up from 49% in 2021. This increase in sorting, recycling and reuse is achieved while the volume of waste from the Bank increased by over 105%, or almost 87 tonnes.

Employee commuting

Landsbankinn emphasises flexibility and offers employees the opportunity to use different workstations, including remote work as and when tasks allow. Landsbankinn also offers employees a transport contract that promotes eco-friendly transport.

Landsbankinn has an agreement with Hopp and employees can utilise scooters from Hopp to run work errands free of charge between 8-17:00 on weekdays. Facilities for cyclists are excellent in the Bank’s new headquarters at Reykjastræti, with spacious bicycle storage and airing cupboards.

We carried out an annual commute survey among employees at year-end 2025 and 67% responded. The survey shows that employees commute to work by the following means: 6% utilise public transportation, 21% walk or cycle, 66% drive own cars and 7% catch a ride. Walking and cycling employees are combined in the same category, with 11% that walk, just over 6% cycle and 8% use electric bicycles or scooters, which are also categorised with walking and cycling.

The majority of employees that drive their own car to and from work drive fossil-fuelled cars. A third of employees drive electric cars and just under 20% drive plug-in hybrids or hybrids.

Total emission from employee commuting was 245 tCO₂e in 2025, down by 10% compared to 2024.

Financed emissions

Landsbankinn is a member of PCAF and has actively participated in the development of a global climate metric for financial institutions within its framework. More than 700 financial institutions have now undertaken to use the PCAF methodology in the assessment of their indirect environmental impact. In general, the main challenge for banks on the road to carbon neutrality has been to assess their indirect environmental impact. In 2022, we became a member of PCAF Nordic, a platform for financial institutions in the Nordic Countries to adapt the methodology to their circumstances in so far as possible and for collaboration on the issues.

The Bank has calculated and analysed total emissions from its loan portfolio, along with other relevant items on its balance sheet, as applicable. In this context, reference is generally made to financed emissions, which include counterparties’ Scope 1 and Scope 2 emissions.

In 2025, the Bank calculated its financed emissions for the fifth time. For 2025, emissions are assessed for the previous year, i.e. 2024, due to data availability.

These emissions are classified as indirect emissions under the fifteenth and final category of Scope 3 according to the GHG Protocol, and in Landsbankinn’s case they account for more than 99% of the Bank’s total emissions. Emission from loans to customers is estimated at 254 ktCO₂e in 2024.

As with the release of the Bank's previous report on financed emissions, an update has been made to the baseline data for the emission factors used by the Bank. New and improved data, which is available from 2020 and 2022 onwards, makes it possible to enhance calculations from 2020 onward, but does not extend back to the base year 2019. This approach is consistent with PCAF and the GHG Protocol, as it ensures that the base year remains stable while other calculations reflect the best available data at any given time. The aim is always to improve basic and supplementary data for carbon calculations. In 2024, the Bank implemented a new sustainability platform called Vera, which provides access to information ESG factors in the operations of Icelandic companies in a standardised manner.

The Bank’s science-based targets (SBTi) to reduce emissions from its credit and asset portfolio use 2019 as a base year. Financed emissions from the Bank’s credit portfolio in 2024 are ca. 12 ktCO₂e lower than in the base year, which can be attributed to lower emissions from corporate customers in the travel sector.

The three sectors in the Bank’s credit portfolio with the highest emissions are the travel sector, fisheries and seafood, and services, IT and telecommunication. These sectors have had the highest emissions since the Bank began calculating its financed emissions in 2019 and are responsible for around 60% of estimated total emissions from the Bank’s credit portfolio.

Fisheries and seafood have the highest emissions in 2024, or 74.4 ktCO₂e. The travel sector on the one hand and services, IT and telecommunications on the other are estimated to have almost equal emissions, or about 53.7 ktCO₂e and 53.0 ktCO₂e respectively. The travel industry has traditionally had the highest total emissions but has also been the sector that has achieved the highest reductions since 2019, when it stood at close to 130 ktCO2e.

Total emissions do not tell the whole story, as it is also necessary to consider the emissions intensity of different industries. Emission intensity refers to the emissions generated per unit of currency lent, and agriculture is the industry with the highest emissions intensity, even though it is not listed above. The next image shows a comparison between an industry’s total emissions and its emissions intensity.

Operation again carbon neutralised

Landsbankinn offsets its emissions from its operations (Scope 1, 2, and 3, excluding financed emissions) through internationally certified projects recognised by the International Carbon Reduction and Offset Alliance (ICROA). Carbon removal has already been carried out. Landsbankinn has been CarbonNeutral® certified since 2020.

For 2025, the Bank purchased 951 tCO₂e to offset its operations (excluding financed emissions), with all credits coming from carbon removal projects. Landsbankinn purchases only carbon credits where sequestration has already taken place and the project has received international certification and been recognised by ICROA.