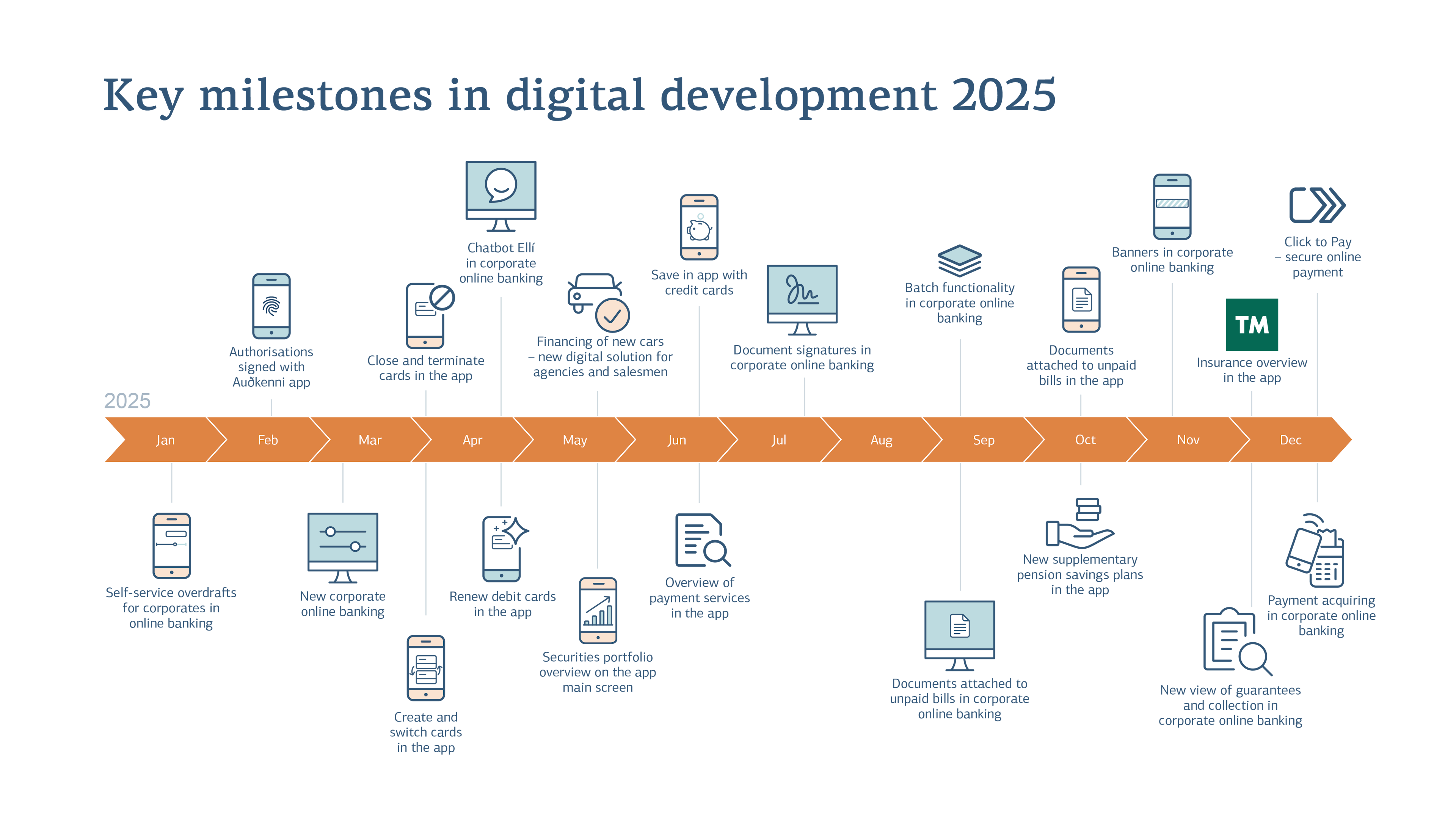

The year was also characterised by extensive system and database upgrades and several of the Bank’s core infrastructures were renewed.

The success of these efforts is reflected in the continued increase in releases of the app, online banking and other technology solutions. In 2025, releases were 15% more numerous than in 2024 and approximately 90% more than in 2021. The number of recorded incidents, i.e. disruptions to the operation of technology solutions, continued to decline and was around 50% lower in 2025 than in 2021.

We have begun applying artificial intelligence in various ways within the Bank’s operations, both in customer-facing services and internal processes, and we will continue to expand its use in the coming months and years. A strong focus on operational resilience and security will remain a top priority, alongside continued emphasis on all aspects of security and fraud prevention.”